Navigating the tricky path of the “Direct to Consumer” website

Thankfully, it’s been many, many years since any manufacturing company said to me “I don’t really sell to the ‘general public’ why would I need a website?”. Most companies who are primarily Business to Business (B2B) have realised the importance of having a web presence, whether that’s for your distributors, your career pages, your Corporate Social Responsibility or ‘just’ your shareholders. Some have built out comprehensive Extranets for their distributors or retailers to manage orders.

But what about Direct to Customer/Consumer (D2C or DTC)?

When considering this route there are two simple questions: ‘Why?’ and then, of course, ‘How?’

Why

D2C is nuanced. Building a site that is aimed directly at end customers doesn’t necessarily mean one that is transactional. McKinsey wrote an interesting article that gave the example of Lays Crisps who used their D2C website to gather consumer insights – running the well known “Do us a Flavor” campaign asking consumers to suggest a new chip flavour. This form of D2C site is the start point of the D2C journey.

In fact, McKinsey went on to say that D2C sites lie on a spectrum as follows:

I am not going to re-write the McKinsey content, you can read the original article here.

The article is primarily focussed on Consumer Packaged Goods (CPG) but the D2C discussion in Manufacturing goes much wider than that. There are still many brands in the manufacturing space who don’t consider they have appeal to end users so don’t invest in building a public-facing brand. But I would challenge that assumption. To give you a few successful, and diverse cases:

Intel: In the early days of computing most consumers didn’t understand or indeed care about the components. The “Intel inside” marketing that the company launched now means that consumers are actually demanding a particular component in their laptop.

Lucas: Lucas have been manufacturing lights since 1875. Their catalogue is now very broad, but they have, through successful brand positioning, become the lighting of choice for major car brands – to the point where consumers actually select Lucas as an option when configuring their vehicle (e.g. BMW laser light option)

Marley: A roof tile is a roof tile, right? Nope. If you’ve ever had to undergo the financially eye-watering task of re-roofing your house, you’ll know Marley. They have successfully positioned themselves in this market such that consumers are demanding their roof tiles when previously this would have been the builder’s choice.

There are, of course many more examples, but these show how some very hidden components can become household names with the right investment in D2C marketing.

How

The development of a D2C presence doesn’t have to be ‘big bang’ and nobody is going to become Intel overnight. The build process can be taken in stages, and the McKinsey model is an interesting one on which to base this.

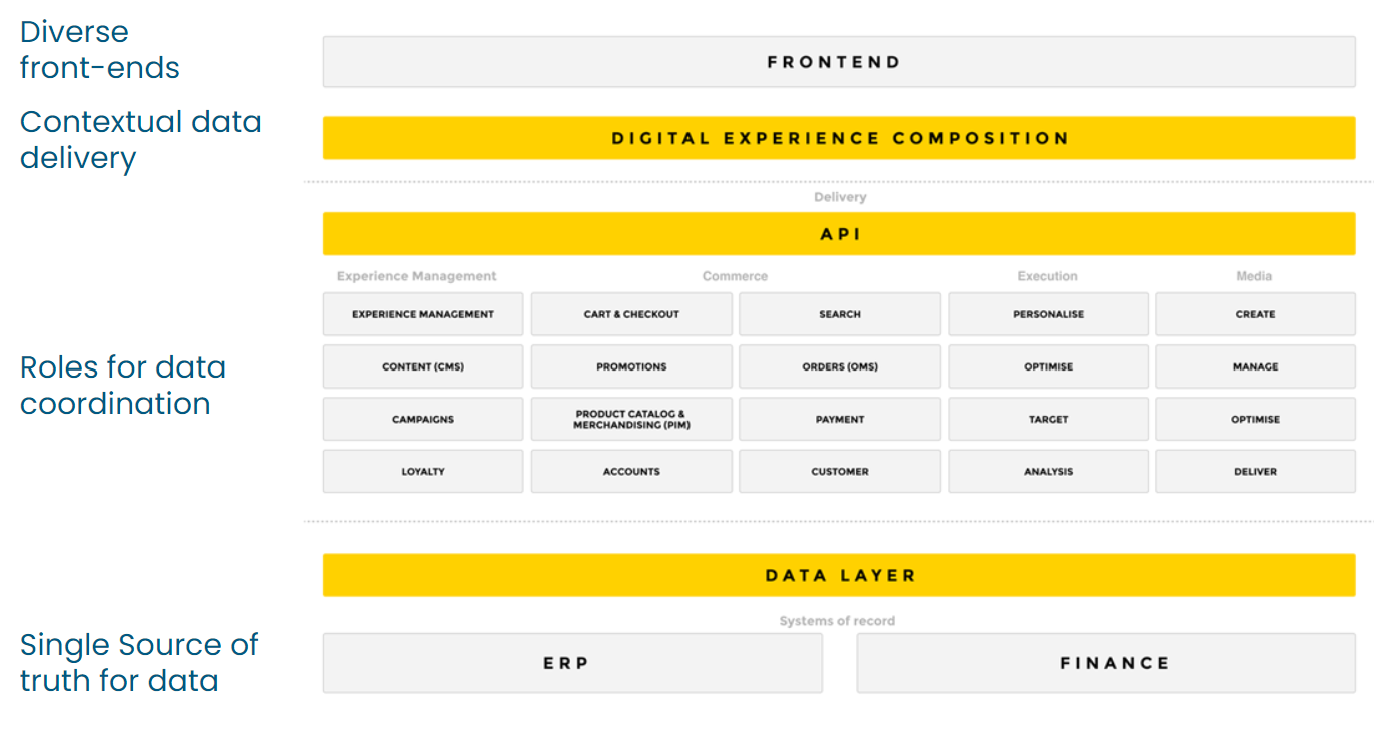

Let’s talk quickly about the MACH architecture, or Composable SaaS. If you look at the MACH Alliance website you’ll see this:

Its not the whole story, and we’ll come to that, but the basic principles are there:

You have your data layer (probably more than just ERP and Finance) there are a number of ‘roles’ to coordinate this data, this is then delivered to the ‘front end’ which is normally a website but can also be many things.

Insights Engine

Returning to the McKinsey model: the first step is to create an “Insights Engine” – this is a stripped-down version of the infrastructure shown in the MACH model. Essentially you’re starting with your own website and social channels.

The purpose of such a site is to give:

A more comprehensive view of consumer behaviour

It can serve as a test bed for innovation, not just in product development but also for other commercial levers such as pricing or online merchandising.

It can provide the foundation for delivering more personalized experiences over time.

From an architecture perspective, you’re pushing content from your Content Management System (CMS), perhaps your Product Information System (PIM) or Digital Assets (DAM) and if you’re collecting insights, that will be into your Customer Relationship Management (CRM). It might look something like this:

Controlling the Brand Experience

In the absence of a good D2C site, you’re leaving your brand positioning, brand story and communication entirely up to your retailers or distributers. As a brand, you want to take greater control of the user experience and provide rich content to your consumers – this could be videos or narratives about product features, ‘how to’ videos or training.

The aim here is to provide a memorable experience that embeds the brand deep into the consumer’s psyche, so that the next time they’re in store, or on a retail site, or in the case of Marley chatting to their builder, it’s your brand that is front and centre.

To excel in this area, the infrastructure needs to be extended to deliver a rich media experience on site, perhaps start to personalise the experience for your visitors and create more targeted messages. Including more advanced customer data collection in the form of a Customer Data Platform (CDP) starts to make sense here as you start to profile customer activity.

Omni-channel marketing engine

Taking the next step looks more at the way you interact with your customers or consumers across all (omni) channels. You’re using the existing infrastructure to delivery coherent content (of all formats) to all the customer touchpoints

This includes your retailer/distributer channels: By proactively pushing your content through the supported APIs that many of the mainstream retailers use, you achieve brand consistency and ensure they’re presenting the latest content (product shots, descriptions, videos, technical specifications).

This brand consistency can be extended into your AdTech channels to ensure the messaging is timely and consistent.

Equally, the content can be repurposed for offline use in packaging, banners, outdoor and other media.

Effectively you’re taking control of the whole content ecosystem, both online and offline, but in doing so you’re also able to gather data across all of the areas to create a complete picture of your consumer and consumer behaviour.

One of my favourite rucksack (backpack) brands is Osprey. Because of the brand loyalty they have with me, when I am in the market for a new pack, I am shopping primarily for Osprey and where I buy it from is secondary (and is really just a price decision). This is very different from a client who has a favourite outdoor sports company, who relies on them to propose the best backpack.

A Sales Driver

The final stage is to become transactional – to actually be part of the buying process directly with your customer. Companies that are running successful B2B operations, which are effectively wholesale, don’t always transition into D2C well. It requires far more than ‘just’ a web shop to achieve this – business processes, logistics, and core changes to your foundational systems (like your ERP) need to be done. But, if the composable route has been taken, then adding the store onto your infrastructure may not too hard, and can be prototyped with a limited range of brands, in a controlled region, or even with just a small portion of your traffic. Then based on these tests, be gradually built up over time.

Clearly, if successful, there is the risk that you cannibalise your retail channels by competing directly with them. However, the opportunity with fully transactional D2C is huge: The margins can be significantly better, and you can reach out into markets that your retailers don’t cover. But perhaps most importantly, you gain a profound understanding of the buying behaviour of your customers.

Your infrastructure might look like this:

For most manufacturers, the online direct sales and sales through retail channels can be balanced and maintained in parallel. This takes the right pricing policies, good Joint Business Plans (JBPs) and a degree of trust. In the high-end luxury goods there are many great examples of brands that have resisted D2C for years for fear of cannibalisation. Dior, Channel and Hermes are all transactional now and embrace all channels.

There are also some good examples of brands that have taken the final step and jettisoned the retailer route altogether; Canyon Bikes and Dell Computers being a couple that spring to mind. By controlling the entire value chain they have consolidated their relationships with the customer and have survived some tough years in their industries by maintaining better margins than their competitors.

In summary

The journey into D2C doesn’t have to be ‘big bang’. Done right it can build on or extend the infrastructure you already have installed. As you develop the D2C model your data insights will improve which in turn will improve your business. You’ll get closer to your customers, and really start to understand their needs, which in turn will help improve your products. Your relationship with your customer and your proximity to the market will give you an edge over your competitors.

If you are considering how to leverage your web presence more effectively and really embrace the Direct to Consumer opportunity, then give me a shout. I can help you build a business plan, look at your processes and consider your infrastructure to make this a success.